LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

x.ai: in-depth analysis

xAI Corp. is a forward-thinking company that is shaping the future of artificial intelligence and striving to unravel the mysteries of the universe. Its groundbreaking work in AI and advanced mathematical reasoning set it apart in the technology sector, making it a company to watch in the coming years.

The Voluntary Carbon Market: A Beginner’s Guide.

Explore the multifaceted structure of the voluntary carbon market (VCM), where standards, development, and verification converge to produce carbon credits. Uncover the strategic role of brokers and end buyers in driving carbon offsetting initiatives. Navigate the regulatory landscape shaped by the Paris Agreement as we delve into the pricing intricacies and tackle the challenges confronting the VCM, including double counting and market inefficiencies. This guide is an insightful beacon for stakeholders engaging in climate action through the voluntary carbon offset market.

Keywords for social media:

#VoluntaryCarbonMarket #CarbonCredits #GreenhouseGas #ParisAgreement #CarbonOffsetting #ClimateAction #Sustainability #CarbonTrading #EnvironmentalIntegrity #Decarbonization #MarketChallenges #LocalOffsetting #ClimateRegulations #CarbonFinance

EPIC Games IPO: Analysis and Investor Insights

Epic Games is steering towards a 2026 IPO with robust growth strategies including significant partnerships and innovative content expansions. This analysis delves into Epic's preparation for its IPO, highlighting strategic collaborations with Disney and LEGO, and its impactful return to mobile gaming platforms, projecting a valuation near $57 billion.

#EpicGames #IPO #GamingIndustry #Fortnite #InvestmentOpportunity #MobileGaming #StrategicPartnerships #Disney #LEGO #InteractiveEntertainment #epic #fortnitecommunity #ps4 #gaming #entertainment #playstation #xbox #epicgamesstock #privateequity #VentureCapital #vc #PreIPO #IPO #investing #familyoffice #wealthmanagement #venture #gamer #gamingcommunity #onlinegaming #newgame

IPO Market pergnant with tech companies.

Discover the vibrant lineup of tech companies ready to debut on the stock market in 2024. From Rubrik and Plaid to Stripe.

Explore how these enterprises are poised to energize the IPO scene despite fluctuating valuations and market conditions.

Keywords: #TechIPOs2024 #DiscordIPO #RedditIPO #ChimeIPO #KlarnaValuation #StripeIPO #CerebrasAI #Stripe #Plaid #Rubrik #VentureBackedCompanies #IPOMarketTrends #StockMarket2024

Stabiliti Enhances Sustainability Efforts through Strategic Partnership with Green Cross UK

Stabiliti teams up with Green Cross UK to bolster global sustainability efforts, leveraging shared visions and innovative carbon removal solutions.

#Stabiliti #GreenCrossUK #Sustainability #CarbonRemoval #StrategicPartnership #ClimateChange #EnvironmentalStewardship #InnovationInSustainability

Dismissed Distributions?

Venture capital’s allure has always been rooted in its promise of outsized returns, derived from the successful incubation and maturation of groundbreaking startups. Yet, there's an emerging narrative that reveals a critical oversight in the venture capital saga: the Dismissed Distributions.

Investing in Boxabl: A tale of two cities.

Exploring the juxtaposition of Boxabl's financial and operational realms, this article mirrors the essence of Charles Dickens's "A Tale of Two Cities," revealing a stark contrast between the company's fiscal challenges and its progressive strides in innovation. Despite disappointing revenue figures and increased liabilities, Boxabl's commitment to enhancing production efficiency and expanding market reach forecasts a promising horizon, underpinned by strategic executive appointments and technological advancements.

ACE NEW YORK $5,000,000 Capital Campaign supported by IPO CLUB.

IPO CLUB proudly supports the Association of Community Employment Programs for the Homeless (ACE), a distinguished 501(c)(3) nonprofit organization committed to transforming lives in New York City. Since 1992, ACE has provided job training, education, and support services to the homeless, aiding their journey toward economic independence and societal reintegration.

Natilus innovates aviation with the Kona

Natilus is revolutionizing aviation with its blended-wing-body aircraft, the Kona, promising to slash emissions and operational costs. This groundbreaking design merges efficiency with sustainability, signaling a new era for the industry.

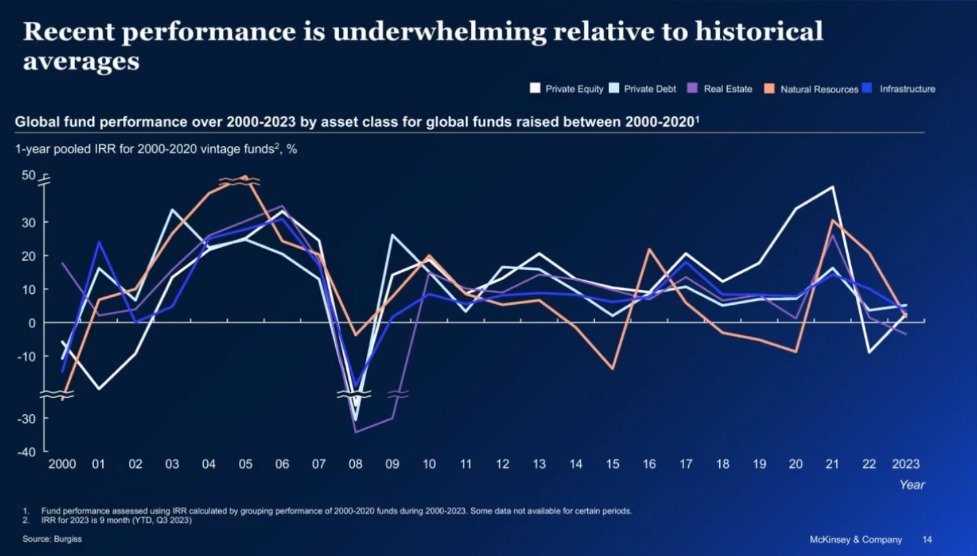

Venture Capital and Private Equity in 2023

Unveiling the 2023 dynamics of private equity and venture capital markets, this analysis delves into PE's resilience amidst global fundraising challenges and VC's strategic pivot in response to economic headwinds. Gain insights into the sectors' performances, trends, and investment shifts.

Rubrik's IPO on the Horizon

Rubrik, a leading light in cloud and data security, is on the verge of a significant leap, preparing to file for an initial public offering (IPO) as early as next week, hoping to raise $500 million to $700 million. Backed by the software giant Microsoft, Rubrik's move is seen as a bellwether for the cloud data management industry and a test of the market's appetite for technology-focused IPOs.

Kraken Unveils Qualified Custody Solution in the US

Discover Kraken's innovative step into the future of crypto with its state-of-the-art qualified custody solution, Kraken Custody. Engineered for institutional investors, this platform offers unmatched security and regulatory compliance, setting a new standard in the digital asset market. Dive into how Kraken Custody is revolutionizing institutional crypto investments and why it's the trusted choice for navigating the complexities of the crypto world.

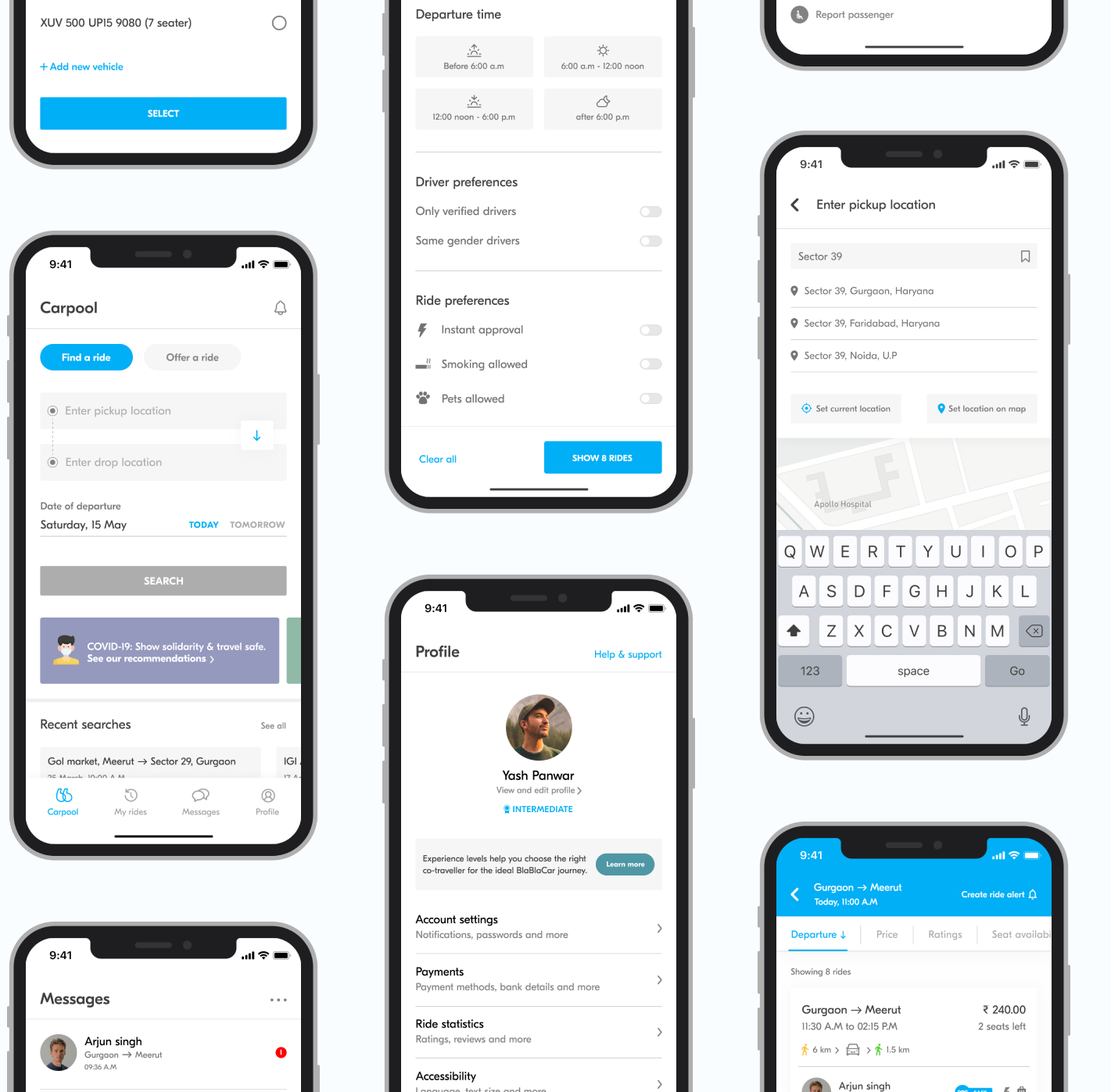

Blablacar secures $100 million credit line

BlaBlaCar secures a €100M credit facility, marking a strategic move for expansion and acquisitions. The company has led in shared mobility with profitability since April 2022 and plans to add train tickets.

Stripe's valuation increased to $65 billion

Stripe's valuation has increased to $65 billion in a recent employee stock sale deal, marking a 30% rise from its valuation in the previous year. This increase contrasts with its $95 billion peak in 2021. The agreement involved buying over $1 billion of shares from current and former employees, with notable participation from investors like Sequoia Capital and Goldman Sachs's growth equity fund. This move, seen as a liquidity provision for employees, postpones the anticipated Stripe IPO, possibly until after 2024.

Pre-IPO: An X Spaces on investing in digital assets

We were recently featured in an X Spaces about investing in digital assets. Here is an excerpt of the chat. AT IPO CLUB We Provide Performance and Safety in Pre-IPO Investments for Accredited Investors.

The Future of Air Freight with Innovative Autonomous Aircraft

Natilus is transforming air freight by introducing a new category of blended wing body autonomous aircraft, aimed at doubling cargo capacity while halving costs. This groundbreaking approach merges the efficiency and safety of air travel with enhanced volume and reduced expenses, potentially expanding the air cargo market to a $470 billion opportunity. Natilus' designs promise fresher, more affordable goods by optimizing transport costs and emissions. Their pilotless aircraft, compatible with current airports, represents a significant leap in logistics, offering a viable solution to the pilot shortage and increasing the safety of operations.

Epic Returns to iOS as Apple Bows to EU

Apple reinstates Epic Games' developer account, allowing the Fortnite creator to launch its European app store under the new Digital Markets Act. Following EU regulatory pressure, this pivotal move marks a seismic shift in app distribution dynamics, promising to reshape the digital marketplace by fostering competition and innovation. This news, compounded with the extreme due diligence that Disney imposed on Epic Games before its $1.5 investment, strengthens Epic Games’ stock price in the private secondary market.

Automation Anywhere: A Game Changer in AI-Powered Savings

Discover how Automation Anywhere revolutionized Petrobras' financial processes, saving $120 million in 3 weeks with AI automation. This milestone showcases their innovation in intelligent automation and significantly boosts their market valuation, highlighting their potential for future growth and investor returns. Explore the transformative power of AI in streamlining operations and driving economic efficiency

Big Things Coming for DataRobot at NVIDIA GTC 2024

Discover how DataRobot and NVIDIA are revolutionizing AI at Nvidia GTC2024. Unleash AI's full potential with their partnership, offering an end-to-end platform and the Catalyst Program for scalable, value-driven AI. Leverage NVIDIA's AI computing leadership to accelerate your AI projects. Join GTC 2024 to transform AI workflows and drive business outcomes.

Why are secondary valuations not rising?

Valuing a private company involves assessing its total worth (numerator) and the number of shares (denominator). If the company's value increases but shares also rise, the per-share value may not grow, akin to a fraction's dynamics. Reasons for rising shares include capital raising, employee compensation, acquisitions, debt conversion, and investor inclusion. To elevate a private stock's price, focus on revenue growth, profitability, strategic partnerships, market expansion, product innovation, and operational efficiency. Investing in venture stocks within bubbles or momentum carries risks and opportunities, demanding careful analysis, market timing, diversification, and risk management strategies.